Amazon

Step-by-Step Amazon Listing Audit Guide in 2025

An Amazon listing audit is one of the most overlooked yet powerful levers for driving visibility, conversion, and profitability on the marketplace. At its core, a listing audit is a systematic review of every element that influences performance such as keywords, copy, images, reviews, compliance, and metrics. Sellers often invest heavily in PPC campaigns, product launches, or external traffic, yet fail to notice that under-optimized listings silently leak sales and ad dollars.

The benefits of a thorough audit are clear: improved discoverability, higher conversion rates, better compliance with Amazon’s policies, and cost savings from smarter advertising spend. So, give this guide a read to know how to do an Amazon listing audit step by step to never miss any opportunity to grow your Amazon brand.

What Data & Tools You’ll Need Before Amazon Listing Audit

An audit is only as strong as the data and tools you use. Here’s what to gather before you begin:

Key Data Sources

- Seller Central Metrics: Sessions, impressions, unit session percentage, conversion rates, and Buy Box percentage.

- Search Term Reports: Insights into customer queries that lead to clicks and sales.

- Brand Analytics: Share of voice, top search terms, and competitor data.

- Customer Reviews & Feedback: Reveals recurring complaints and unmet expectations.

Tools & Utilities

- Keyword Research Tools: Helium10, Jungle Scout, DataDive, or Amazon’s own Brand Analytics.

- Listing Quality Analyzers: Tools that flag missing keywords, non-compliance, or formatting errors.

- Image Check Tools: Resolution, background compliance, and mobile render previews.

- Index Checkers: To confirm whether your listing ranks for target keywords.

Step 1: Keyword & Indexing Audit

Keywords are the oxygen of your Amazon listing because without them, your product won’t be found. A keyword and indexing audit ensures your listing is discoverable and competitive.

Primary vs. Secondary Keywords

Primary keywords are broad, high-volume terms (e.g., wireless earbuds). Secondary and long-tail variations (e.g., Bluetooth earbuds for running) capture niche intent and often convert better because they match specific customer needs. A strong listing balances both—primary terms drive visibility, while secondary terms drive conversions.

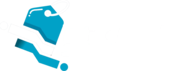

Keyword Placement

Amazon assigns different weights to listing fields:

- Title: highest priority for primary keywords.

- Bullets: blend of primary and secondary terms.

- Description & A+: lower ranking weight, but support conversion.

- Backend fields: capture synonyms, misspellings, and hidden terms.

Indexing Check

Adding a keyword doesn’t guarantee indexing. Use manual searches (ASIN + keyword) or tools like Helium10 to confirm. Non-indexed terms should be repositioned or reworded to unlock visibility.

Competitor Gaps

Compare your keyword coverage with top competitors. If they rank for terms you’re missing, like waterproof earbuds, you’re leaving sales on the table. Gap analysis also surfaces semantic variations (e.g., earbuds vs. earphones) that widen your reach.

Why Long-Tail Matters

Over 60% of Amazon sales come from queries beyond the top 10 keywords (Marketplace Pulse). Competing for broad terms is tough, but long-tail phrases are often easier, cheaper, and more profitable, especially for new ASINs.

Step 2: Copy & Content Audit (Title, Bullets, Description, A+ Content)

Strong copy is more than keyword placement, it persuades, reassures, and aligns with customer intent. A copy and content audit ensures your words are both search-friendly and conversion-driven.

Titles

The title is your listing’s headline and the most heavily weighted field for ranking. It must balance relevance, readability, and compliance.

- Include primary keywords naturally without stuffing.

- Keep it policy-safe (no claims like “Best Seller” or “#1 Rated”).

- Make it readable. Titles should flow for humans, not just algorithms.

A strong title tells buyers what the product is, what makes it unique, and why it’s relevant in under 200 characters.

Bullet Points

Bullets are where you persuade at a glance. Buyers skim, so every line must deliver value.

- Focus on benefits first, then features.

- Feature: “Made from stainless steel.”

- Benefit: “Durable stainless steel that resists rust and lasts years.”

- Integrate secondary and long-tail keywords naturally.

- Keep them scannable: short, structured, and easy to digest.

Bullets are also where you answer common objections such as durability, sizing, compatibility, or safety.

Description & A+ Content

Your description and A+ modules let you expand storytelling and showcase brand authority.

- Use HTML formatting in descriptions (bold, line breaks) for readability.

- A+ Content should blend visuals with copy such as comparison charts, lifestyle modules, feature callouts.

- Prioritize mobile-first formatting, since over 77% of Amazon traffic comes from mobile devices.

- Reinforce benefits that reviews often highlight or complaints competitors overlook.

Done well, A+ Content can increase conversions by 5–20% depending on category.

Tone & Consistency

Tone builds trust. Your copy should:

- Be professional, clear, and benefit-oriented.

- Stay consistent across title, bullets, and A+.

- Avoid over-claims (like “guaranteed results” or “cures X”), which can trigger compliance issues or suppressions.

A clear, credible tone positions your brand as reliable and customer-focused.

Step 3: Check for Visuals in Amazon Listing Audit

On Amazon, shoppers can’t touch or test your product so they buy with their eyes. Visuals act as the substitute for physical experience, and according to eMarketer, 75% of shoppers say product images heavily influence purchase decisions. A visuals and media audit ensures your images, videos, and design elements aren’t just compliant but also persuasive enough to drive conversions.

Main Image

The main image is the first impression your listing makes in search results.

- Amazon requires a pure white background with no text, logos, or props that misrepresent the product.

- Resolution must be at least 1000×1000 pixels to enable zoom (a feature buyers expect).

- The image should show the product clearly and accurately, without deceptive angles or edits.

A poor-quality main image instantly lowers CTR and can lead to suppressed listings.

Secondary Images

Secondary images give shoppers context and confidence.

- Lifestyle images: Show the product in use (e.g., earbuds worn while jogging).

- Infographics: Highlight dimensions, features, or benefits visually.

- Comparison charts: Differentiate your product from competitors or other models in your range.

- Detail close-ups: Provide clarity on materials, textures, or unique features.

The goal is to reduce uncertainty so that the customers should feel they know the product before buying.

A+ Content Visuals

If your brand is registered, A+ Content modules give you space to tell your story visually.

- Keep branding consistent with fonts, colors, and style.

- Use clean, high-resolution images across modules.

- Balance text with visuals: avoid clutter, but provide enough context for decision-making.

Strong A+ visuals can increase conversion rates by 5–20%, especially in competitive categories.

Video Content

Video is no longer optional. Amazon listings with videos consistently outperform those without.

- Product demos: Show how it works in real life.

- Tutorials: Help customers use it correctly.

- Unboxing videos: Create trust and excitement.

Even a short, 30-second lifestyle clip can dramatically improve engagement and reduce returns.

Mobile Check

With more than 77% of Amazon traffic coming from mobile, it’s critical to verify that your visuals display correctly across devices.

- Check if infographics remain legible on smaller screens.

- Ensure images don’t crop awkwardly on the app.

- Preview A+ content on mobile to confirm readability.

Mobile-friendly visuals ensure you don’t lose customers who browse and buy on phones first.

Step 4: Pricing, Offers & Buy Box Factors

No matter how optimized your keywords, copy, or visuals are, price remains one of the biggest conversion drivers on Amazon. Shoppers compare similar products instantly, and even small pricing or Buy Box shifts can make or break your sales. According to Profitero, in competitive categories a 1% price difference can swing Buy Box share significantly. A pricing and Buy Box audit ensures your listing is competitive and positioned to win conversions consistently.

Competitor Pricing

Amazon is a price-sensitive marketplace where customers can compare products side by side.

- Track competitor pricing daily or use repricing tools to stay within a competitive band.

- Avoid racing to the bottom because undercutting competitors too much can hurt margins and signal low quality.

- Consider psychological pricing (e.g., $19.95 vs. $20) to make your listing appear more attractive.

The key is balancing visibility with profitability, not simply being the cheapest option.

Promotions & Offers

Strategic promotions give your listing a temporary boost in CTR and sales velocity.

- Coupons (green tags) often improve click-through rates because they stand out visually in search.

- Lightning Deals create urgency and lift short-term sales.

- Bundles or multi-packs can improve perceived value while raising average order value.

Used wisely, these tools can accelerate ranking, especially during product launches or seasonal spikes.

Fulfillment Method

Your fulfillment choice directly impacts Buy Box eligibility and customer trust.

- FBA (Fulfilled by Amazon) gives you Prime eligibility, faster delivery, and higher Buy Box odds.

- FBM (Fulfilled by Merchant) may make sense for oversized, heavy, or low-margin products but often loses to FBA sellers.

- SFP (Seller Fulfilled Prime) is an alternative but comes with strict requirements for delivery and performance.

For most sellers, FBA remains the safest path to higher conversion and visibility.

Buy Box Eligibility

The Buy Box is where most sales happen and if you don’t own it, your optimization efforts are wasted. Factors influencing Buy Box eligibility include:

- Pricing competitiveness.

- Fulfillment method (Prime usually wins).

- Seller performance metrics (late shipment rate, cancellation rate, etc.).

- Inventory levels (stockouts can lose you the Buy Box).

Monitoring Buy Box share daily is critical; even a well-optimized listing won’t convert if a competitor captures the Buy Box at a lower price.

Step 5: Reviews, Reputation & Q&A Audit

On Amazon, customer trust is earned through social proof. No matter how optimized your keywords or images are, shoppers will hesitate if your reviews and Q&A lack credibility. According to BrightLocal, 84% of consumers trust online reviews as much as personal recommendations. That makes this part of your audit critical for both conversion and long-term brand reputation.

Review Quantity & Rating

A healthy number of reviews gives your listing authority. Aim for at least 20–30 reviews to build initial trust, with an average rating above 4.2 stars. Listings with too few reviews or low star ratings often get filtered out by customers who compare multiple options side by side. Beyond the numbers, look at review velocity. Steady, recent reviews show your product is active and relevant, while long gaps between feedback may reduce confidence.

Patterns in Complaints

Reviews reveal more than just sentiment, they expose weaknesses.

- Packaging issues, unclear instructions, or sizing problems often appear repeatedly.

- Some problems may require product fixes, but others can be solved directly in the listing.

- For example, if buyers say “the bottle is smaller than expected,” you could add an infographic comparing size to a common object.

By auditing complaint patterns and addressing them proactively, you reduce future negative reviews and improve buyer satisfaction.

Q&A Section

The Q&A area works like a public FAQ. Many sellers ignore it, but it strongly influences trust. Customers read existing questions to confirm details before purchase. Unanswered or vague responses can create doubt, while clear, prompt answers strengthen credibility. If multiple shoppers ask about the same thing, like compatibility, warranty, or materials, that’s a signal those details should be updated in bullets, A+ modules, or even images.

Trust Signals

Shoppers don’t just look at how many reviews you have—they look at the quality of those reviews.

- Verified Purchase badges show authenticity.

- Recent reviews reassure buyers that your product is still consistent.

- Reviewer diversity (different types of customers, geographies, and use cases) adds realism.

- A mix of positive and constructive reviews often feels more authentic than only glowing 5-star praise.

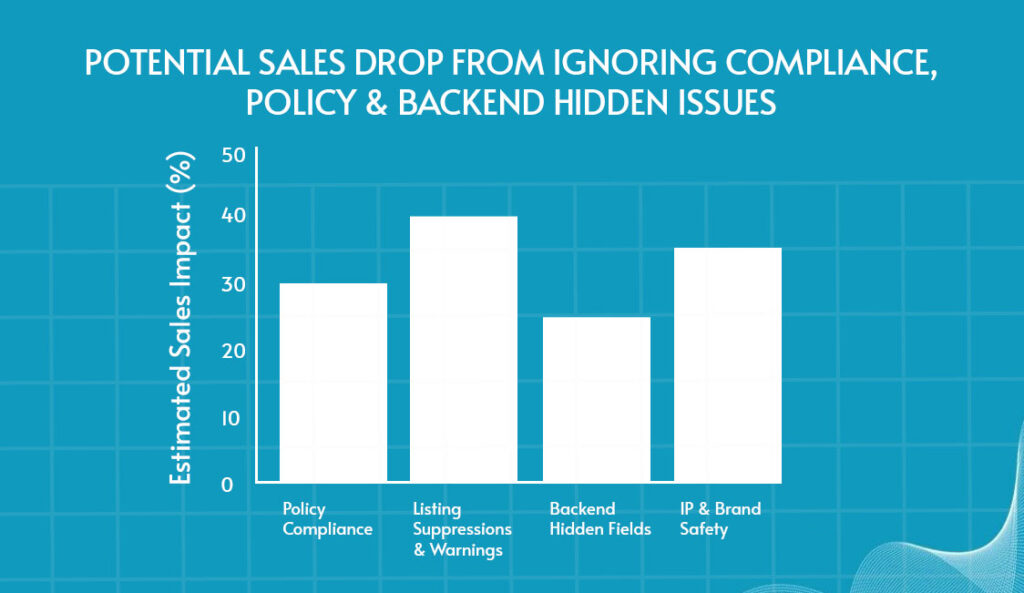

Step 6: Compliance, Policy & Backend Hidden Issues

Even the best-optimized listings can be derailed if they violate Amazon’s rules. Policy compliance and backend accuracy are silent performance factors which you won’t always notice until your listing gets suppressed or flagged. An audit here ensures your product remains visible, safe, and eligible to win sales without risking account health.

Policy Compliance

Amazon enforces strict content standards.

- Prohibited claims: Health, medical, or performance guarantees (“cures,” “guaranteed results”) can trigger suppressions.

- Trademark or brand misuse: Using competitor brand names in keywords or bullets is a violation.

- Regulated categories: Products like supplements, electronics, or baby items face stricter wording and imagery rules.

A compliance audit checks that your copy and visuals align with Amazon’s content guidelines and avoid risky phrases.

Listing Suppressions & Warnings

Suppressed or stranded listings hurt discoverability immediately. Amazon may suppress listings for issues like missing images, incomplete attributes, or keyword violations. Warnings in Seller Central often appear before suppressions and an audit should catch and address these before they escalate.

Backend Hidden Fields

The backend of your listing carries more weight than many sellers realize.

- Fields such as intended use, material, target audience, and product type can improve indexing and relevance.

- Hidden keywords allow you to capture search terms that don’t fit naturally in customer-facing copy.

- Neglected or incomplete backend fields are often why products underperform in search.

Intellectual Property & Brand Safety

Amazon takes IP and authenticity issues seriously. During your audit:

- Confirm your own trademarks and brand registry are properly filed and reflected in listings.

- Check for unintentional violations, like using copyrighted imagery or phrases.

- Review competitor complaints or false IP claims that might put your ASINs at risk.

Protecting your listing from disputes safeguards long-term visibility and sales.

Policy Compliance

Amazon enforces strict content standards.

- Prohibited claims: Health, medical, or performance guarantees (“cures,” “guaranteed results”) can trigger suppressions.

- Trademark or brand misuse: Using competitor brand names in keywords or bullets is a violation.

- Regulated categories: Products like supplements, electronics, or baby items face stricter wording and imagery rules.

A compliance audit checks that your copy and visuals align with Amazon’s content guidelines and avoid risky phrases.

Listing Suppressions & Warnings

Suppressed or stranded listings hurt discoverability immediately. Amazon may suppress listings for issues like missing images, incomplete attributes, or keyword violations. Warnings in Seller Central often appear before suppressions and an audit should catch and address these before they escalate.

Backend Hidden Fields

The backend of your listing carries more weight than many sellers realize.

- Fields such as intended use, material, target audience, and product type can improve indexing and relevance.

- Hidden keywords allow you to capture search terms that don’t fit naturally in customer-facing copy.

- Neglected or incomplete backend fields are often why products underperform in search.

Intellectual Property & Brand Safety

Amazon takes IP and authenticity issues seriously. During your audit:

- Confirm your own trademarks and brand registry are properly filed and reflected in listings.

- Check for unintentional violations, like using copyrighted imagery or phrases.

- Review competitor complaints or false IP claims that might put your ASINs at risk.

Protecting your listing from disputes safeguards long-term visibility and sales.

Step 7: Performance Metrics & Measurement Plan

Without measurement, an audit is just a checklist. You can optimize keywords, improve visuals, or rewrite bullets, but unless you track results, you’ll never know if your changes made an impact. A solid measurement plan ensures every adjustment translates into real improvements in traffic, conversions, and sales.

Key Metrics to Monitor

Amazon’s built-in metrics give you a clear picture of listing health. From seeing your product in search to purchasing it (or returning it), each one reflects a different stage of the shopper journey.

| Metric | What It Reflects | Common Issues |

| CTR (Click-Through Rate) | How attractive your title, main image, and price are in search results | Weak main image, uncompetitive pricing |

| CVR (Conversion Rate / Unit Session %) | Ability to convert visitors into buyers | Poor copy, low reviews, unclear visuals |

| Sessions | Volume of traffic reaching your listing | Ranking loss, indexing problems, reduced ad spend |

| Buy Box % | Share of time you control the Buy Box | Competitor pricing, weak fulfillment method |

| Return Rate | Accuracy of listing vs. customer expectations | Misleading images, unclear descriptions |

Benchmarks Matter

Metrics only make sense when measured against context. A 12% conversion rate may look impressive in electronics but underwhelming in beauty, where 20% or higher is common. Benchmarks should come from three sources: your category averages, your own historical performance, and competitor data through tools like Brand Analytics. This comparison helps you set realistic goals and identify whether issues are listing-specific or reflective of broader market dynamics.

Before & After Tracking

Every optimization should be measurable.

- Record baseline metrics before making changes.

- Re-measure at 30, 60, and 90 days to capture both short-term indexing improvements and longer-term conversion shifts.

- Adjust based on the trends: if CTR rises but CVR drops, you may have attracted more traffic but failed to convince buyers, signaling a content or reviews issue.

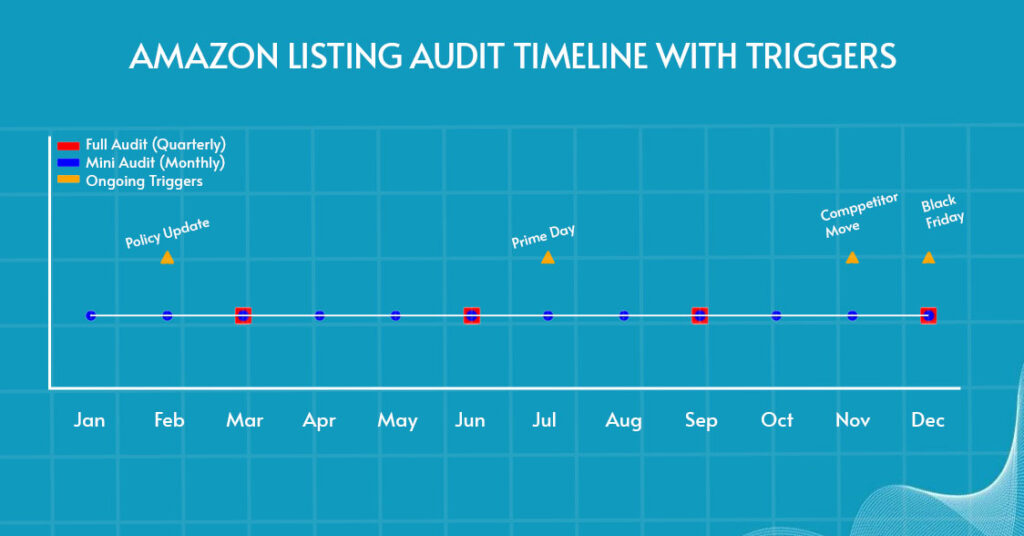

Re-check Frequency

Audits should not be one-and-done. Amazon’s marketplace is dynamic, and competitor strategies evolve quickly.

- Mini-audits: Every 30 days to check CTR, indexing, and Buy Box share.

- Full audits: Every 3–6 months to review all listing elements in depth.

- Event-based audits: Triggered by sales declines, suppressed listings, or seasonal peaks like Prime Day and Q4.

How Often to Audit & What Triggers to Watch For

An Amazon listing audit is not a one-time activity. The marketplace is dynamic, algorithms evolve, competitors adjust strategies, and customer expectations shift quickly. To stay competitive, you need both a scheduled audit routine and a trigger-based approach that alerts you when it’s time to review outside of the calendar cycle.

Full Audits

A full audit is an in-depth review of every aspect of your listing—keywords, copy, visuals, reviews, backend fields, pricing, and compliance. These should be done every 3–6 months. For sellers in highly competitive niches, quarterly reviews are best to stay ahead. Think of it as a health checkup: you may not always find major problems, but it prevents small issues from growing into costly mistakes.

Mini Audits

Between full audits, you should run mini audits monthly. These are faster checks that focus on high-impact areas:

- Are your keywords still indexed?

- Has CTR dropped due to weak titles or images?

- Do your visuals meet Amazon’s latest compliance requirements?

Mini audits keep you agile. They help you spot issues early before they drag down traffic and sales.

Ongoing Checks

Not everything fits neatly into a schedule. Some elements need ongoing monitoring, especially when Amazon or the market shifts:

- New Amazon policies can suddenly make certain claims or formats non-compliant.

- Seasonal events (Prime Day, Black Friday, Q4) require readiness checks for offers, visuals, and inventory.

- Competitor behavior like aggressive repricing or content updates may demand a response.

This flexible layer ensures your listing remains aligned with marketplace conditions.

Triggers That Demand Immediate Audits

Certain red flags should trigger an immediate audit, regardless of when your last review was.

- Sudden drop in traffic or impressions.

- A decline in sales despite steady traffic.

- Rising ad spend with lower ROI.

- Suppressed or stranded listings in Seller Central.

- New policy enforcement or warnings.

- Spikes in negative reviews or repeated complaints.

- Competitors suddenly outranking you for high-value keywords.

These events signal urgent issues that need to be diagnosed and corrected before they snowball.

Conclusion

An Amazon listing audit isn’t a one-time task, it’s an ongoing process of refinement and optimization. By regularly reviewing your keywords, copy, visuals, pricing, reviews, compliance, and performance metrics, you keep your products competitive in an increasingly crowded marketplace.

The real difference comes from consistency. Sellers who audit on a routine basis are better prepared to adapt to Amazon’s evolving policies, shifting algorithms, and the pressure of rising competition.

This is where Prime Retail Solution (PRS) comes in. We partner with brands, distributors, and retailers to go beyond checklists and build sustainable growth strategies. From listing optimization and advertising management to logistics, fulfillment, and marketplace expansion, PRS provides a comprehensive solution designed to uncover problems, fix them quickly, and position your brand for long-term success.

Ready to see where your listings stand? Book a free consultation call with Prime Retail Solution today, and let our experts turn your audit insights into measurable growth.

FAQs

Q1. How long does an Amazon listing audit take?

A mini-audit can take a few hours, while a full audit may take several days depending on catalog size.

Q2. How often should I audit my listings?

Do mini-audits monthly and full audits every 3–6 months, with extra checks after sales drops or policy changes.

Q3. Can I do an audit myself or do I need professional help?

Basic audits can be done with Seller Central and tools like Helium10, but experts add depth and strategy.

Q4. Will frequent updates hurt my ranking on Amazon?

No. Updates that follow Amazon’s guidelines usually improve performance and keep your listing competitive.Q5. What should I measure after completing an audit?

Track CTR, CVR, sessions, Buy Box percentage, and return rate at 30, 60, and 90 days.

Share