Amazon

Amazon Subscribe & Save: Strategic Evaluation for Your Brand Portfolio

For Amazon brands managing the ecommerce store, the goal is clear—maximize recurring sales while deepening customer loyalty. One of the most effective ways to do this on Amazon is by using Subscribe & Save (SnS). Yet for many brand owners, the decision to activate or scale this program across a product portfolio is not as simple as it looks. Should you activate SnS for your entire catalog? Which SKUs benefit most? And how can a single 3P selling partner help you make smart decisions without disrupting your supply chain or margins?

These are the strategic questions brand owners need to answer—not from a theoretical angle, but from a profitability-first perspective.

What Is Amazon Subscribe & Save and Why Should 3P Sellers Care?

Amazon Subscribe & Save is a customer loyalty program that offers discounts on repeat purchases. Buyers can choose to have eligible products automatically delivered on a schedule—monthly, bimonthly, or at other intervals they choose. In exchange for offering a 5% to 15% discount, brands gain access to higher conversion rates, better visibility on listings, and a stronger repeat customer base.

From a brand owner’s perspective, SnS is a tool for predictability. It helps forecast demand, smooth out fulfillment planning, and reduce advertising costs over time. But without the right execution plan, it can eat into margins, cause stockouts, or create pricing conflicts—especially for brands selling across multiple channels.

Why Strategic Evaluation Matters for Established Brands

SnS is not a one-size-fits-all tool. Applying it across your entire catalog just because it’s available can create more problems than benefits.

At Prime Retail Solution, we’ve worked with brands that rushed into SnS—offering it on low-margin items, bundling the wrong SKUs, or failing to manage the inventory flow required for consistent fulfillment. The result? Discounted revenue with little to no lift in long-term brand growth.

To get real ROI from the program, you need a category-specific, SKU-specific strategy that supports your brand equity, customer retention goals, and profitability benchmarks.

Key Factors to Evaluate Before Activating Subscribe & Save

1. SKU Qualification and Replenishment Cycle

Not every product belongs in the SnS program. Focus on ASINs that meet three key criteria:

- High purchase frequency (consumables, personal care, household essentials)

- Strong organic ranking

- Above-average retention potential

Think through the actual use cycle of the product. Does your customer really need this every month? Or are they more likely to reorder every 90 days? Match the program’s frequency options to real-world usage to avoid churn or cancellations.

2. Discount Structure and Margin Impact

Amazon allows sellers to offer:

- 5% base discount (required to enroll)

- Up to 15% total discount if customers subscribe to 5+ products in a month

As a brand owner, this discount comes from your pocket. It’s critical to map out the margin impact—especially if you’re already spending on PPC, coupons, and off-Amazon promotions.

We recommend building a contribution margin model per ASIN before enrolling. This should include:

- FBA fees

- Advertising cost of sale (ACoS)

- Promotional spend

- SnS discount layers

Use this to decide which products can absorb the SnS program without undercutting profits.

3. Inventory Planning & Forecasting

The SnS program depends on inventory availability. If your product goes out of stock, Amazon will cancel subscriptions—hurting your reliability score and customer experience.

Use Amazon’s Subscribe & Save Forecasting Reports to plan 30, 60, and 90-day replenishment windows. Be conservative in the early rollout to avoid overcommitting stock.

4. Brand Control and Pricing Strategy

Many established brands manage both 1P and 3P channels, along with external retailers. If your product is priced lower on Amazon due to SnS, it may disrupt MAP policies or cause friction with retail partners.

A solid 3P strategy should include price consistency planning across channels. This is where working with an experienced Amazon 3P selling partner becomes essential.

Role of a 3P Selling Partner in Scaling Subscribe & Save

As a brand grows, the risks of DIY SnS management increase. A 3P partner like Prime Retail Solution helps brands:

- Identify high-opportunity SKUs using real-time sales data and Amazon reports

- Build ASIN-level SnS strategies to balance growth and profitability

- Manage inventory flow through FBA to prevent disruptions

- Align promotions and pricing with broader brand strategy

We don’t treat SnS as a checkbox. We treat it as a revenue retention tool that works best when it’s tied directly to a brand’s goals.

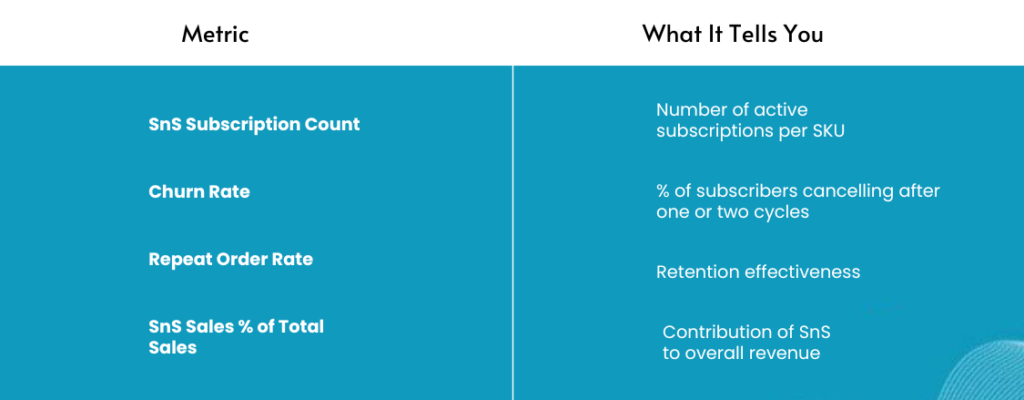

Metrics That Matter: How to Measure SnS Success

Once you launch SnS for selected products, monitor performance using key metrics:

Run monthly reviews to track trends. If churn spikes or profitability dips, adjust frequency or consider removing the product.

Final Thoughts: Make Subscribe & Save Work for Your Brand

Subscribe & Save isn’t just a checkbox—it’s a lever. For established brands on Amazon, it can drive consistent reorders, lower customer acquisition costs, and reinforce loyalty. But when not managed carefully, it can also drain margins, disrupt inventory flow, and create friction across channels.

That’s where a 3P selling partner like Prime Retail Solution makes the difference. We help established brands cut through the guesswork, run the numbers, and launch Subscribe & Save only where it adds value.Let’s evaluate your brand’s Amazon opportunities together—book a free strategy session with Prime Retail Solution today.

Share