Amazon

Amazon’s Market Expansion: Strategic Considerations for Global Brands Ready to Scale

Why Global Growth Isn’t Plug-and-Play on Amazon

For established brands already selling on Amazon in the U.S. or UK, expanding into new Amazon markets seems like a natural next move. But what looks like a simple “add marketplace” button inside Seller Central quickly turns into a complex web of decisions around pricing, operations, content, compliance, and customer experience.

Many Amazon brands enter global markets too fast or without a clear roadmap. The result? Sinking margins, low visibility, inventory headaches, and frustrated teams stretched thin across time zones. There’s plenty of upside in Amazon market expansion—but only when it’s done with precision.

Problem: Global Expansion Creates New Blind Spots

Scaling your Amazon business internationally isn’t just about listing your catalog on Amazon Germany or Japan. It introduces a new set of variables that your team may not be equipped to handle without help:

- Do your SKUs meet local compliance requirements?

- Is your retail pricing model sustainable after import duties and fees?

- Are your PPC campaigns converting in other languages?

- Is your brand content optimized for local keywords and cultural context?

Without answers to these questions, expansion can drain resources and stall momentum.

Key Considerations for Amazon Global Market Expansion

1. How Localization Affects Conversion and Brand Perception

A direct translation of your U.S. listings rarely performs well in other countries. Localization goes beyond language—it includes cultural tone, pricing cues, and product expectations.

Checklist for High-Performing International Listings:

- Localized keyword research using native-speaking translators or AI keyword tools

- Product titles restructured to match regional search behavior

- Images updated to reflect local use cases, lifestyle cues, or regulations

- A+ Content reviewed for cultural fit and product clarity

- Bullet points tailored to emphasize benefits relevant to the local customer

2. Profitability Hinges on Cross-Market Price Modeling

You can’t just copy-paste your U.S. pricing. Import duties, VAT, local fees, and fulfillment costs shift your margins in every region.

Profit Modeling Tips by Region:

- Use landed cost calculators (like Amazon’s Build International Listings tool or third-party software) to factor in shipping, duties, and fees.

- Adjust pricing to account for currency volatility (especially in LATAM or Asia).

- Set minimum margin thresholds per ASIN per market to avoid loss leaders.

What top-performing Amazon brands do differently:

They segment their catalog—only launching high-velocity, high-margin SKUs in new markets first. Then scale once profitability is proven.

3. PPC and Organic Strategies Don’t Scale One-to-One

If you rely on PPC data from your home market, expect poor ROI when applied globally. Search behavior, ad competition, and keyword intent vary widely by region.

4. FBA Isn’t a One-Size-Fits-All Fulfillment Strategy

Fulfillment gets complicated when you’re operating across continents. Using FBA Global Export or the Pan-EU program might sound efficient, but both come with trade-offs in terms of control, speed, and cost.

Key Questions to Align Fulfillment Strategy:

- Is local FBA storage more cost-effective than cross-border shipping?

- Are there local Third Party Logistic (3PL) partners with better regional shipping SLAs?

- Should you keep inventory lean in test markets to limit exposure?

At Prime Retail Solution, we often help brands run split fulfillment strategies: testing smaller SKUs in global marketplaces through our strategically distributed warehouses, while keeping tight inventory controls via local partners.

5. Brand Registry Access Must Be Managed by Region

Many brands overlook that Amazon Brand Registry doesn’t automatically carry over to each new marketplace. Without proper brand ownership setup, you may lose control over listings, A+ content, or get undercut by rogue sellers.

If you’re already a registered seller on Seller Central, enroll your brand in Amazon Brand Registry right away, if you haven’t already, to access the brand protection tools by Amazon, including Amazon Transparency Program, Project Zero, IP Accelerator etc.

6. Use Your U.S. Data to Prioritize Global Rollouts

Before launching in five countries at once, use your current Amazon data to rank which markets make the most sense for your brand.

Use these signals to prioritize:

- Geographic customer demand (via brand search reports or DTC data)

- Organic international sales via global shipping

- Existing brand awareness or competitors in each market

- Regulatory hurdles by category (EU compliance is stricter than NA)

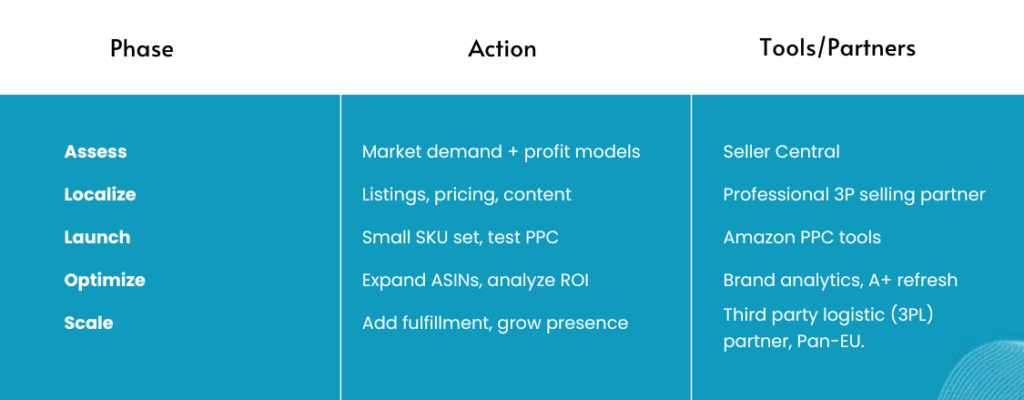

Global Expansion Strategy Framework

Here’s a quick view of how top brands structure their international rollout:

Final Takeaway: Plan Like a Global Retailer, Not Just an Amazon Seller

Expanding into Amazon’s global markets is a high-leverage move—but only when it’s backed by strong local execution. Brands that approach this with a long-term plan win more often than those rushing in for quick wins.

At Prime Retail Solution, we help Amazon 3P sellers handle everything from cross-border logistics to localized content, channel control, PPC setup, and catalog strategy. If your team is considering new global marketplaces, we can build a custom expansion roadmap aligned with your KPIs, margin goals, and retail footprint. Contact us today!

Share