Amazon

How to Monitor 3P Sales and Performance Analytics

With the surge in the trend of online shopping, a rise in the number of 3P sellers have been observed. Amazon reports that in 2022, 57% of the total sales were from 3P seller and the Q2 report of 2025 by Amazon shows that this number has already reached 60%. It depicts that the trend of 3P sellers will keep increasing because the brands consider them as a reliable source to expand their reach and sales as well.

But this comes with associated risks including undermining the brand’s actual pricing, poor customer management, and overall hurting the brand’s reputation. Because 3P sellers become the front image on 3P marketplaces and brands lose the control over their standing position in the market.

That’s the reason third party marketplace sales monitoring is non-negotiable. In this article, you’ll learn how to effectively monitor 3P performance and 3P analytics.

What Are 3P Sellers, and Why Should You Monitor Them?

Third-party (3P) sellers are vendors who list products on a marketplace platform without being the brand owner or first-party distributor. They source products independently and manage their own:

- Pricing

- Fulfillment

- Customer service

- Inventory levels

When this happens at scale, 3P sellers can unintentionally (or intentionally) create major issues for your brand. Without proper oversight, you might see:

- Your premium product listed at 30% below MAP pricing

- Inaccurate product images or titles

- Negative reviews from poor fulfillment

- Buy Box losses that tank your organic conversions

So, monitoring third party performance will keep you in the loop with what’s going on at the front store. Subsequently, you can ask the brands to ensure consistency, control price perception, and ultimately protect the customer perception about your brand.

The Rise of Multi-Channel Marketplaces: A New Challenge

As more marketplaces emerge and expand across regions, multi-channel selling has become the norm. Most brands are no longer limited to Amazon. They’re on Bol.com in the Netherlands, Allegro in Poland, and Walmart in the US. Apart from selling on multi-channel marketplace, some even run their own DTC shops alongside these platforms.

Each of these marketplaces comes with its own rules, data formats, and seller visibility. That’s where the challenge begins. When you operate across multiple platforms with multiple sellers, you lose the ability to “see everything” at once.

Without multi-channel 3P analytics, it becomes difficult to answer:

- Who’s selling my products across all marketplaces?

- Are my products priced correctly everywhere?

- How many units are third-party sellers moving?

Are any listings damaging my brand?

And perhaps most importantly: how do I take action quickly?

The Core Metrics That Matter for 3P Performance

While talking about monitoring 3P performance on third party marketplaces, we’re not referring to “just tracking sales”. It’s just a part of it but in a broader view, monitoring about understanding how third-party behavior impacts your brand, and where that behavior creates either risk or opportunity.

Here are the key performance indicators (KPIs) you need to track across your third-party sellers:

| Metrics | What It Tells You |

| Sales Volume | How much 3P sellers are selling per SKU or product group |

| Buy Box Ownership | Who owns the Buy Box (you vs. unauthorized sellers) |

| MAP Violation Frequency | How often price falls below your set policy |

| Return Rate | Possible indicator of fulfillment or product issues |

| Fulfillment SLA Compliance | Whether sellers ship on time and handle returns properly |

| Customer Ratings and Reviews | Qualitative feedback tied to seller performance |

By monitoring these consistently, you can spot performance gaps and act before they snowball.

For example, if you see a drop in Buy Box share alongside a spike in poor reviews, it may indicate a non-compliant seller causing customer dissatisfaction.

What Tools Are Used to Monitor Third-Party Marketplaces?

Modern brands don’t monitor manually. Instead, they rely on third-party performance monitoring tools that connect directly to marketplaces and consolidate key data in real time.

Let’s break down a few of the most commonly used platforms:

- ChannelAdvisor

With ChannelAdvisor, you can manage product listings, pricing, inventory, and orders across 100+ global marketplaces. Its automation features take better care of SKU distribution, repricing, and channel-specific content compliance. Many enterprise retailers use ChannelAdvisor for scaling operations and reducing manual errors in multi-channel marketplace.

- Feedvisor

Feedvisor uses algorithmic pricing to evaluate the competitors’ pricing and set the pricing of your brand accordingly. It also keeps a check on the profit margins for Amazon 3P sellers. It can be a good tool to have for you as it provides SKU-level analytics, buy box tracking, and real-time demand forecasting.

- CommerceIQ

CommerceIQ uses AI to automate retail media, sales forecasting, and supply chain actions on Amazon. With this tool in your techstack, you can monitor third-party seller behavior, MAP compliance, and buy box metrics in real time. Usually, consumer brands hop on this one to grow and protect 3P sales performance on Amazon.

- DataHawk

If Amazon and Walmart are your targeted marketplaces where you want to see the third party performance of the sellers, DataHawk is the one for you.It centralizes Amazon and Walmart marketplace data across sales, SEO, advertising, and content performance. With this one, you can track 3P seller activity, pricing changes, and organic visibility trends.

- JungleScout Cobalt

Cobalt is JungleScout’s enterprise suite that keeps on up to date on the market trends and competitors’ patterns. It offers seller share-of-voice metrics, SKU performance benchmarking, and product opportunity scoring. So, if you’re operating a large enterprise already and managing multiple ASINs, consider getting hands on this one. It also helps you in spotting the unauthorized seller’s activity on a third party marketplace.

- Minderest

For price intelligence and MAP enforcement across online marketplaces and retail websites, Minderest is a good to grab. It scans thousands of listings daily to detect violations, price erosion, or grey-market activity. Brands use it to maintain pricing consistency and stop revenue leakage across 3P channels.

These tools allow your teams to better monitor third party sales, centralize reporting, set automated alerts, and investigate issues with fewer manual hours.

Why Monitoring 3P Sellers Is Difficult Without Tools

Even if you know which metrics to watch, the data challenge is real. Third-party marketplaces are notoriously inconsistent with:

- Reporting formats

- Seller transparency

- Real-time data access

And this issue escalates, when it’s a multi-channel marketplace. The brands who try to track without tools mostly struggle with issues like fragmented data silos across marketplaces like Amazon EU, Bol.com, and Walmart US, lost control on the damaged listings, and untracked behavior across varied platforms. At the end, they’re left with no choices other than reactive problem solving.

The third party monitoring tools help not only keep a check on third party sales but also counterfeit all the above issues. That too in an effective, efficient, and resource-friendly way.

How AI Helps Brands Monitor 3P Performance Smarter and Faster

In 2025, if some brand is still relying on manual monitoring of third party marketplace 3P sellers, they’re really living under the stone. AI-driven tools have stepped up the whole and now keeping a check on multi channel analytics and third party sales have become way more convenient. It’s because artificial intelligence helps brands automate the hardest parts of 3P monitoring: detecting problems early, understanding root causes, and predicting future issues.

Here are a few practical ways AI enhances 3P monitoring:

- NLP Surfaces Recurring Seller and SKU-level Issues

NLP(Natural Language Processing) algorithms scan and analyze thousands of customer reviews to detect patterns that might otherwise go unnoticed by your team. Instead of reading reviews manually, NLP breaks them down into categories such as delivery issues, product defects, packaging complaints, or inaccurate descriptions.

For example, if a specific third-party seller repeatedly receives reviews like “wrong size delivered” or “missing parts,” NLP engines will cluster those mentions and associate them with that seller or ASIN. This makes it easy to identify fulfillment problems tied to a specific partner, even before ratings start to drop

- Computer Vision Detects Unauthorized Content Use

Brands can validate the product images with the help of computer vision models as they analyze them pixel by pixel. These models can identify whether the correct product packaging is being used, whether the logo appears in the right format, or if a seller has uploaded misleading imagery.

This is especially useful when unauthorized sellers hijack listings by uploading different product shots, bundles, or counterfeit packaging.

- Predictive Models Forecast Buy Box Loss

Buy Box ownership is one of the most critical metrics for 3P performance. AI-driven predictive models use real-time and historical data to estimate when a product is at risk of losing the Buy Box due to factors like price undercutting, delayed shipments, or stockouts.

These models consider competitive pricing behavior, seller reputation, and availability data to anticipate shifts in Buy Box control, days before they actually happen.

- Sentiment Analysis Maps Customer Satisfaction Trends

There’s no debate about whether you can do reviews evaluation manually or not. The point is AI takes it to the next level. AI-powered sentiment analysis evaluates the reviews at scale, across multiple regions and languages. These tools extract sentiment scores (positive, neutral, negative) and associate them with specific sellers, SKUs, and fulfillment types (FBA vs. FBM).

How to Monitor 3P Sales on Amazon?

Amazon remains the most advanced yet most complex platform when it comes to third-party seller behavior. It’s also where unauthorized seller issues are most common.

To effectively monitor 3P Amazon sellers, you need access to:

- ASIN-level data as it shows which sellers are active on your listings

- Buy Box tracking to know when your authorized partners lose visibility

- MAP violation alerts particularly for high-volume SKUs

- Seller rating and delivery metrics to assess reliability

- Review tracking segmented by fulfillment method (FBA, FBM, etc.)

Amazon Brand Registry and Amazon MWS or SP-API can give you some of this, but for full visibility you typically need tools like CommerceIQ, Helium10, or SellerApp.

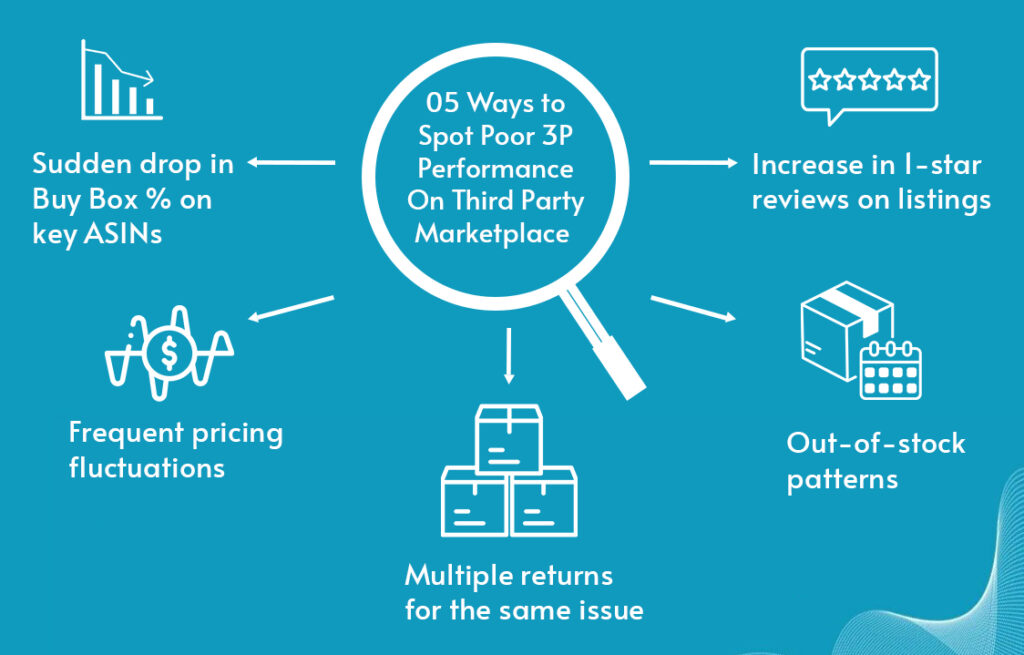

How to Spot Poor 3P Performance on Third Party Marketplace

Relying only on the dashboards to track the micro issues is just like chasing a wild goose. You need to dig deeper to find out the micro ones that may stand up as a major setback for your business if not fixed at the right time.

Here’s what to watch for:

- Sudden drop in Buy Box % on key ASINs

- Increase in 1-star reviews on listings previously rated 4.5+

- Frequent pricing fluctuations on your top SKUs

- Out-of-stock patterns from specific sellers during high-demand periods

- Multiple returns for the same issue (e.g., “wrong color” or “damaged”)

When these happen, look deeper than the surface metrics. Most of the time, you’ll find third party sellers as the root cause of the poor performance on the third party marketplace, not your own product.

How to Improve 3P Seller Outcomes

Once you’re tracking seller behavior properly, the next step is improving it. That requires both carrots and sticks: enablement for high performers, enforcement for low performers.

5 Ways to Improve Third-Party Seller Performance:

- Onboard Sellers With Clear Guidelines: Create branded onboarding packs with fulfillment, pricing, and content rules.

- Incentivize Top Sellers: Offer co-op marketing funds or preferred placement to compliant sellers.

- Audit Low-Performing Sellers Quarterly: Use data to flag persistent violators and remove them.

- Provide Centralized Assets: Share images, copy, and compliance rules to ensure consistency.

- Hold Regular QBRs: Meet with key sellers every quarter to align on performance goals.

Over time, brands that actively manage their third-party sellers see higher conversion rates, fewer violations, and stronger marketplace margins.

End Note

In conclusion, 3P sellers are a way to boost your reach and sales, yes. But is it okay to sign the deal and leave the rest on them? Definitely no or it might hurt your overall brand’s reputation. So, it’s crucial to monitor third party sales and 3P analytics on third party marketplaces. But what comes behind tracking, monitoring, and optimizing? It’s looking for an authentic and reliable 3P partner that complies with your code of conduct and helps you expand your reach and sales.

If you’re looking for any such, Prime Retail Solution is the one. We have been partnered with 100+ brands already and helped them with hitting their growth objectives with our years of experience. So, let’s book a free consultation call straightaway and explore the potential of your business together.

FAQs

Q1: Why is 3P monitoring important for brands?

Because 3P sellers impact pricing, customer experience, and brand reputation directly.

Q2: Which metrics matter most when tracking 3P performance?

Buy Box share, MAP violations, fulfillment compliance, reviews, and return rates.

Q3: Why is it hard to track 3P sellers across platforms?

Each marketplace has different data formats and visibility rules, making manual tracking unreliable.

Q4: How does AI improve 3P monitoring?

AI spots issues like unauthorized images, review trends, and pricing violations faster and at scale.

Q5: What can brands do to improve 3P seller performance?

Set clear rules, audit regularly, provide assets, and maintain performance-based partnerships.

Share