Amazon

Role of Third-Party Sellers in Cross-Border and Multi-Channel Selling

Global e-commerce will approach $6.9 trillion by 2025, with 20% of transactions already cross-border. However, setting up a storefront in varied local markets isn’t an easy-to-do step. This gave third-party marketplace (3P) models a boom. With third-party (3P) marketplace models, sellers can directly reach the local buyers globally via platforms like Amazon, eBay, Walmart, Alibaba, TikTok Shop, and Temu that too without building local storefronts.

Likewise, another trend has been noticed that shoppers now browse an average of four marketplaces every three months. This clearly indicates that relying only on one marketplace is no longer enough. If you are looking to capture the maximum audience, you need to start focusing on multichannel selling. making multi-marketplace strategy vital for visibility and revenue diversification.

However, be it cross-border selling or multimarketplace selling, they both come with multiple complexities including VAT compliance, customs duties, SKU synchronization, feed management, and many more others.

Here comes 3P sellers as a solution to all. How? Continue reading this blog to understand the role of 3P sellers in crossborder selling and multi channel selling.

What Is 3P Cross-Border Commerce and Why Is It Growing?

3P cross-border commerce is when independent sellers list their products on third-party marketplaces like Amazon, eBay, Walmart, Alibaba, or regional platforms. This model is a cornerstone of the cross border ecommerce market, as it lets businesses expand globally without building standalone international websites.

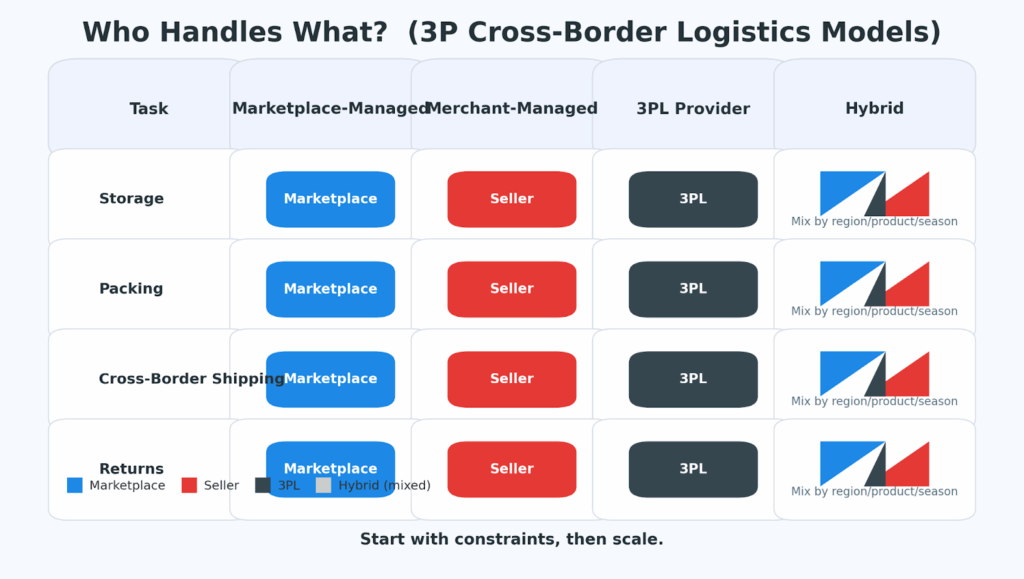

However, a question must be popping in your mind about the logistics management across borders. So, when you’re selling on third party marketplaces, there are a few options for logistics management. Such as:

- Marketplace-Managed Fulfillment: In this one, sellers can avail the in-house services of marketplaces such as storage, packing, and delivery services.

- Merchant-Managed Fulfillment: In this model, sellers handle warehousing, packaging, and cross border ecommerce shipping themselves.

- Third-Party Logistics (3PL) Providers: Independent logistics companies provide services of warehousing, international shipping, and returns handling.

- Hybrid Logistics Models: This is a hybrid approach that combines marketplace-managed services, in-house fulfillment, and 3PL support depending on the product line, region, or season.

Multi-Marketplace Selling: Why It’s Trending?

Multichannel selling simply means operating across several 3P marketplaces and regional platforms to diversify the channels bringing up the revenue. With the rise of cross border selling, multimarket selling also got traction.

Why so? Let’s suppose, you’re operating your business in the United States with a store on Amazon. But now, you’re looking forward to expanding it in other regions like Thailand. As their majority audience is on “Shopee”, you need to make your presence there to grab the market. This is what we call multi-marketplace selling and apart from cross border selling, sellers also look up for multi marketplace selling due to other reasons such as:

- To expand reach

- To diversify revenue streams

- To reduce dependency on one site’s algorithms or policies

Retailers like Gap and Victoria’s Secret are popular examples of multichannel selling. Once they were hesitant to step in this ecosystem only to later realize that it’s a booming way to boost visibility and conversion across both domestic and cross border selling channels.

Trends Shaping Cross-Border Multi-Channel Selling (2024–2025)

As the consumers behavior patterns are evolving so the trends of cross border and multi channel selling as well. Every day, we wake up with some new shifts including some emerging marketplace, tool or regulation. This impacts the 3P sellers and retailers both. For this reason, they must stay ahead of these shifts to remain competitive.

- Emerging Marketplaces

Relying solely on Amazon, eBay, and Alibaba might help you sustain in the market but to beat the bullrun, you need to show up on the emerging global marketplaces as well. Here are a few that have just entered the market and caught all the eyes:

- TikTok Shop: Hit $100M in US sales during Black Friday 2024, setting a trend of live shopping.

- Temu: It’s now open to US-based third party marketplace sellers and people are calling it a direct competitor of Amazon.

- Regional leaders: MercadoLibre (LATAM), Zalando (Europe) attracting niche sellers.

- Cross-Platform Fulfillment Integrations

To make the multiplatform selling hassle free for the 3P sellers and retailers, some platforms are offering bridging solutions. Such as in 2025 Walmart has partnered with Amazon’s Multi-Channel Fulfillment (MCF). This partnership lets sellers use FBA inventory for Walmart orders in unbranded packaging that ultimately reduces the logistics costs while maintaining delivery standards.

- Role of AI and Automation

The noise of AI and automation is everywhere. The below table will give you an overview of how AI has evolved the nuances of cross border selling and multi channel selling:

| AI/ Automation Use Case | Benefit for Cross Border Selling |

| Dynamic pricing engines | Adjust prices per currency and demand in real time |

| Automated catalog translation | Speeds localization for multiple regions |

| Predictive inventory forecasting | Reduces stockouts and overstock risks |

| AI-powered listing optimization | Improves marketplace SEO visibility |

- Regulatory Changes Impacting Global Sellers

- EU VAT collection rules now place responsibility on marketplaces for low-value orders, simplifying tax compliance for individual sellers.

- US de minimis threshold ($800 duty-free limit) faces potential tightening, affecting high-volume cross border ecommerce shipping from Asia.

- Stricter product safety and labeling requirements in key markets require active regulatory intelligence monitoring.

- Seller Sentiment and Strategic Shifts

In community forums, experienced sellers stress that multi seller marketplace operations require robust SKU synchronization, compliance planning, and localized marketing. The consensus: automation + diversification is the safest path for scaling cross border selling in 2025 and beyond.

5 Best Practices for Scaling 3P Cross-Border Operations

Scaling cross border selling across multiple 3P marketplaces is not just about listing products on more channels, it’s about building an operational model that can sustain growth, absorb market shocks, and adapt to changing buyer behavior.

The most successful sellers treat expansion as a strategic process, layering marketplace selection, fulfillment orchestration, localization, paid visibility, and brand protection into one integrated framework.

1. Selective Marketplace Expansion

Blindly listing on every available multi seller marketplace often spreads resources thin and leads to inefficiency. Experienced sellers begin with a product–market fit analysis, assessing each platform’s audience, competitive saturation, and operational requirements.

Why it matters:

- Selling on Amazon may provide immediate traffic but high competition.

- Regional marketplaces like Zalando or MercadoLibre may offer lower competition and a niche audience.

- Some platforms are better suited for B2B cross border ecommerce, such as Alibaba.

Sellers use unified commerce solutions to compare performance metrics like conversion rate, average order value, and return rates across marketplaces. Performance dashboards then inform decisions about where to double down and where to pull back.

Strategic Tip: Launch on 1–3 high-potential platforms first, monitor KPIs for at least two sales cycles, then expand systematically.

2. Centralized Inventory & Order Management

One of the most common causes of third party operational risk in multi-channel commerce is inventory mismanagement. Overselling leads to order cancellations, which can harm seller ratings and reduce buy box eligibility.

By integrating fulfillment orchestration tools and inventory forecasting systems, sellers can:

- Sync SKUs across all sales channels in real time.

- Centralize order processing into one dashboard for better visibility

- Automatically route orders to the nearest fulfillment center, reducing delivery times and shipping costs.

- Anticipate demand spikes using predictive analytics tied to seasonal and regional sales trends.

For cross border ecommerce shipping, predictive inventory allocation ensures that high-demand SKUs are stocked in the right warehouses before peak events like Prime Day or Singles’ Day.

3. Localizing the Buyer Experience

Global buyers want to shop in a familiar environment, in their own language, currency, and cultural context. Localization engines make it possible to adapt listings quickly for different markets, while translation memory systems maintain brand consistency across languages.

Effective localization covers:

- Currency display and dynamic pricing to match local purchasing power.

- Unit conversions (imperial to metric) and region-specific product visuals.

- Payment options aligned with buyer preferences (mobile wallets in APAC, COD in MENA, PayPal in Europe).

- Customer support in local languages and time zones.

Sellers who invest in this level of detail often see improved conversion rates, stronger product reviews, and reduced return rates.

4. Using Retail Media Networks

Marketplaces are becoming ad ecosystems. Cross-channel retail media lets sellers target shoppers based on search behavior, purchase history, and demographics.

By running sponsored product and sponsored brand campaigns, sellers can rapidly boost visibility for both new and established SKUs.

Enhanced brand content including premium images, videos, and comparison charts — improves click-through rates and builds trust, especially in competitive categories.

Data from multiple global marketplaces shows that sellers allocating 10–15% of revenue to Retail Media Networks often achieve sustained ranking improvements beyond the ad campaign period.

5. Compliance and Brand Protection

In cross border ecommerce, regulatory missteps can lead to listing removal, fines, or shipment seizures. At the same time, brand dilution is a real threat when unauthorized sellers list counterfeit or grey-market goods.

Best practices include:

- Registering trademarks with brand registry management programs across all marketplaces.

- Using unauthorized seller controls to detect and report infringing listings.

- Implementing compliance management processes to meet labeling, packaging, and product safety standards per region.

- Monitoring regulatory intelligence sources to anticipate changes before they impact sales.

Pro Insight: Some sellers automate compliance checks using AI tools that flag missing attributes or documentation before listings go live.

Building a Repeatable Cycle for Successful Cross Border and Multi-Channel Selling

Scaling in 3P marketplace solutions is most sustainable when sellers follow a cyclical process:

- Analyze — Use performance dashboards to identify the best-fit channels.

- Optimize — Tailor product content and pricing for each region.

- Automate — Centralize and synchronize orders, SKUs, and inventory.

- Promote — Drive visibility with RMNs and enhanced content.

- Protect — Guard brand equity with registry and compliance measures.

- Expand — Enter new markets incrementally with proven processes.

This approach ensures sellers can grow without losing operational control, even as cross border ecommerce trends and platform policies evolve.

Conclusion

Winning in cross border and multi channel selling comes from fast learning and fast action. Watch policy changes, track demand, and move pricing, ads, and inventory together. Prime Retail Solution acts as your hands on 3P retail partner so you can do this with confidence.

With years of experience in 3P marketplaces management, we set up VAT and IOSS, handle duties, keep product safety and labeling compliant, sync SKUs and feeds, run unified orders and inventory, and orchestrate FBA, MCF, WFS, and 3PL. Our analytics spot early shifts and our automations adjust pricing, allocation, and campaigns in real time. If you want to scale with control and reduce risk, let PRS carry the operational load while your brand focuses on growth. Book a free strategy call.

FAQs

Q1: What is 3P cross-border commerce?

It’s selling through third-party marketplaces to reach buyers in other countries without building local websites. You list products, manage ops, and tap marketplace traffic and payments.

Q2: Which marketplaces should I start with?

Begin where your product has fit and logistics are workable. Validate fees, categories, and delivery options on Amazon, eBay, Walmart, and regional leaders like MercadoLibre, Zalando, Shopee, or TikTok Shop.

Q3: How do I choose a fulfillment model?

Match it to order volume, speed goals, and operations maturity. Lean teams needing Prime-like speed often start with marketplace-managed. High volume with strong ops can run merchant-managed. Complex international needs suit 3PL. Mixed regions or seasons favor a hybrid.

Q4: What AI and automation should I implement first?

Start with dynamic pricing, automated translation and localization, predictive inventory, and AI-driven listing optimization. Connect these to your order and ad systems and prioritize your highest-velocity SKUs.

Q5: What are the top compliance and brand risks?

VAT or IOSS registration, duties and customs paperwork, safety and labeling rules, and unauthorized resellers. Keep a compliance calendar, enroll in brand registries, and monitor policy updates in each target market.

Share