Amazon

Stockouts Hand the Buy Box to Grey-Market Sellers—Here’s Why

When brands talk about losing the Amazon Buy Box, the conversation usually centers on pricing pressure, review count, or seller performance metrics. Inventory availability rarely gets the same attention. That’s a mistake.

On Amazon, stockouts don’t pause performance. They trigger a reallocation of visibility. The moment a listing goes out of stock, the Buy Box opens to other sellers, and Amazon fills that gap immediately. In many cases, the sellers best positioned to step in are grey-market or unauthorized sellers with inventory ready to ship.

Understanding how Amazon stockouts lead to Buy Box loss is essential for brands that want to protect pricing, customer experience, and long-term catalog control.

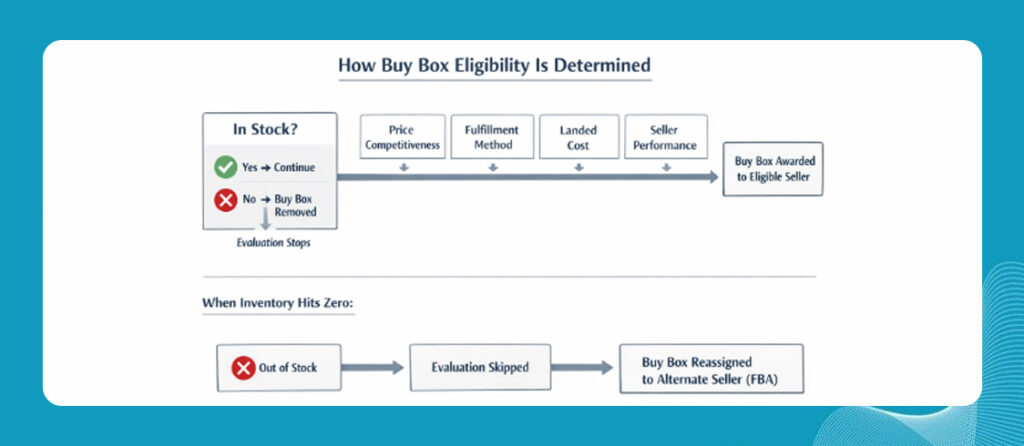

How Stockouts Affect Buy Box Eligibility

Amazon evaluates Buy Box eligibility through multiple performance and pricing signals, but these signals are only considered when inventory is available. Once availability is removed, the evaluation process changes entirely. Understanding how this shift occurs explains why Buy Box loss during stockouts is both immediate and difficult to reverse.

In-Stock Status Is a Non-Negotiable Buy Box Signal

The Amazon Buy Box algorithm evaluates several factors, including price competitiveness, fulfillment method, landed cost, and seller performance metrics such as order defect rate (ODR). However, inventory availability is the first filter.

If a seller is out of stock, they are no longer eligible to win the Buy Box. Authorization status, Brand Registry enrollment, and historical Buy Box ownership do not override this requirement. From Amazon’s perspective, a seller who cannot fulfill orders cannot own the Buy Box.

This is why brands frequently lose the Buy Box due to stockouts, even when they outperform competitors on every other metric.

What Happens the Moment Inventory Hits Zero

When inventory runs out, Amazon does not wait for replenishment. Buy Box ownership shifts to sellers who can fulfill immediately, often through FBA. As this happens:

- Buy Box visibility is reassigned

- Buy Box rotation favors available sellers

- Organic and paid traffic redirects instantly

This transition is automatic and predictable. The Buy Box prioritizes availability over affiliation.

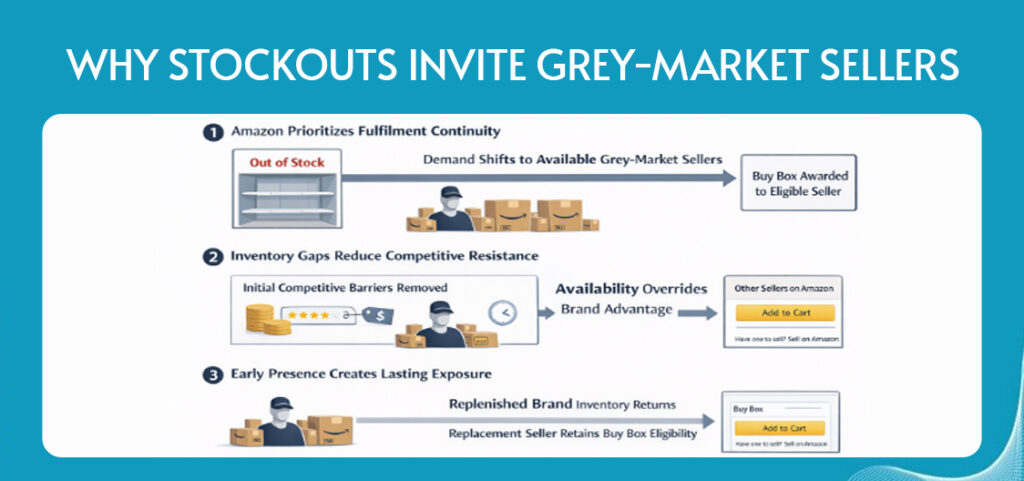

Why Stockouts Invite Grey-Market Sellers

Stockouts do more than interrupt sales. They change how Amazon allocates demand across a listing. When brand-controlled inventory is no longer available, Amazon shifts its priority from brand alignment to fulfillment continuity. This creates exposure that grey-market sellers are specifically positioned to exploit.

Understanding these conditions helps explain why stockouts often coincide with an increase in unauthorized seller activity.

1. Amazon Prioritizes Fulfillment Continuity

Amazon’s primary objective is to ensure uninterrupted purchasing. The Buy Box exists to streamline the customer experience by presenting a seller who can fulfill an order immediately and reliably. When a brand runs out of inventory, that objective becomes the sole focus.

Availability is a gating requirement for Buy Box eligibility. If brand inventory is unavailable, Amazon reallocates demand to sellers who can ship now, regardless of whether they are authorized by the brand. Brand Registry enrollment, historical performance, and prior Buy Box ownership are not considered when inventory is unavailable.

2. Inventory Gaps Reduce Competitive Resistance

When brand inventory is in stock, competing sellers must overcome several barriers, including pricing pressure, review strength, fulfillment speed, and established Buy Box history. Stockouts remove these barriers entirely.

Without brand presence on the listing, grey-market sellers do not need to outcompete the brand on price, reviews, or reputation. They only need to be available. Sellers with pre-positioned inventory, particularly through FBA, can step in quickly and gain immediate exposure.

3. Early Presence Creates Lasting Exposure

The first sellers to fulfill orders during a stockout benefit from early visibility and order flow. These initial transactions establish participation in the Buy Box ecosystem for that ASIN.

Even after brand inventory is restored, the effects of this early presence can persist. Replacement sellers may retain Buy Box eligibility, continue receiving rotation, and remain visible to shoppers. What begins as a temporary absence can result in ongoing competition.

How Grey-Market Sellers Win the Buy Box During Stockouts

Once stockouts create exposure, Buy Box ownership is determined by execution. Amazon evaluates sellers based on their ability to fulfill orders consistently and competitively. Grey-market sellers that meet these requirements can secure and maintain Buy Box share.

Inventory Availability Outweighs Seller Authorization

Many brands assume that authorization or Brand Registry participation prevents Buy Box loss. In practice, Buy Box eligibility is execution-based.

Sellers with in-stock inventory, competitive landed cost, and reliable fulfillment qualify for Buy Box consideration regardless of their relationship with the brand. Authorization status does not offset availability gaps.

This is why grey-market sellers with inventory on hand are often able to win Buy Box share as soon as a stockout occurs.

Buy Box Rotation Rewards Uninterrupted Fulfillment

During stockout periods, Amazon’s Buy Box rotation favors sellers who maintain continuous availability. Sellers that fulfill orders without interruption signal reliability to the algorithm.

Even short windows of consistent fulfillment can generate performance signals that extend beyond the stockout period. As these sellers continue to meet demand, they build Buy Box history that improves their chances of ongoing rotation, even after the brand restocks.

The Compounding Impact of Buy Box Loss

Buy Box loss does not end when inventory is replenished. Once control shifts away from the brand, the effects extend beyond short-term visibility and begin to influence pricing, performance history, and customer experience. These downstream impacts are often harder to reverse than the stockout itself.

1. Slower Buy Box Recovery

Restocking inventory does not immediately restore Buy Box ownership. Once Buy Box history shifts, the brand must compete again for eligibility, often against sellers who have been fulfilling orders consistently during the stockout. This leads to slower Buy Box recovery, even when inventory levels return to normal.

2. Reduced Pricing Control

Grey-market sellers frequently compete on price. Once they gain visibility, undercutting becomes more visible and more difficult to control. Over time, this creates downward pressure on pricing and weakens MAP enforcement.

3. Inconsistent Customer Experience

Multiple sellers introduce variability in fulfillment speed, packaging, and post-purchase support. From the customer’s perspective, the brand experience becomes fragmented, even though the brand does not control the seller relationship.

5 Practical Tips How Brands Can Protect Buy Box Control

Protecting the Buy Box requires more than competitive pricing or reactive enforcement. It depends on maintaining consistent availability, reducing execution gaps, and limiting opportunities for unauthorized sellers to step in. The following practices help brands reduce Buy Box risk and maintain long-term control.

1. Maintain Continuous In-Stock Coverage

Availability is the foundation of Buy Box eligibility. Brands should plan buffer inventory that accounts for demand volatility, inbound delays, and seasonal spikes. Prioritizing continuity over aggressive inventory efficiency reduces exposure during unexpected disruptions.

2. Align Forecasting With Buy Box Risk

Forecasting should account for more than sell-through and revenue targets. Incorporating Buy Box exposure risk into planning helps brands identify when low inventory levels may lead to visibility loss, not just missed sales.

3. Reduce Inbound and Check-In Delays

Optimizing inbound workflows helps minimize the window between shipment arrival and Buy Box eligibility. This includes earlier shipment triggers, diversified inbound lanes, and closer monitoring of FBA processing timelines.

4. Limit Fragmented Inventory Ownership

Fragmented inventory increases the likelihood of Buy Box leakage. Centralizing inventory execution, whether through brand-owned stock or controlled partners—reduces competitive entry points and stabilizes Buy Box rotation.

5. Monitor Availability and Buy Box Changes Proactively

Regular monitoring of in-stock status and Buy Box ownership allows brands to respond before gaps widen. Early intervention during low-inventory periods can prevent grey-market sellers from gaining initial Buy Box exposure.

How Prime Retail Solution Protects Buy Box Control

Prime Retail Solution approaches Buy Box protection as an execution discipline, not a reactive enforcement task. By combining inventory ownership, fulfillment consistency, and pricing control, PRS helps brands reduce Buy Box volatility and limit grey-market exposure.

1. Inventory Ownership Ensures Continuous Availability

PRS purchases and owns inventory directly, allowing consistent in-stock coverage even when brand-side replenishment faces delays or constraints. This ownership structure removes reliance on inbound timing and reduces the risk of availability gaps that invite replacement sellers.

2. FBA-First Fulfillment Maintains Buy Box Eligibility

All inventory is positioned for reliable FBA fulfillment. This ensures fast delivery, consistent performance metrics, and uninterrupted Buy Box eligibility during high-demand or constrained periods.

3. Centralized Execution Reduces Seller Fragmentation

By consolidating inventory execution under a single 3P operator, PRS limits fragmented ownership across multiple sellers. This reduces Buy Box rotation instability and minimizes entry points for unauthorized competitors.

4. Pricing Discipline Protects Buy Box Stability

PRS maintains controlled pricing aligned with brand strategy. Consistent landed cost management and disciplined pricing help prevent undercutting scenarios that often emerge after stockouts.

5. Proactive Monitoring Prevents Buy Box Leakage

Inventory levels, Buy Box ownership, and availability signals are monitored continuously. Early intervention during low-inventory periods helps prevent grey-market sellers from gaining initial Buy Box exposure.

Conclusion

When a brand stocks out, the Buy Box does not disappear. It is reassigned. The only real question is who is positioned to replace you when inventory runs out. Brands that plan for Buy Box continuity retain control. Brands that don’t leave the decision to Amazon, and Amazon will always choose availability.

If maintaining Buy Box control is critical to your Amazon strategy, Prime Retail Solution helps brands reduce stockout risk, stabilize Buy Box ownership, and limit grey-market exposure through consistent inventory execution.

Connect with our team to evaluate your Buy Box risk and availability strategy.

FAQs

Q1: Why do brands lose the Amazon Buy Box when they stock out?

Brands lose the Amazon Buy Box when they stock out because availability is a mandatory requirement for Buy Box eligibility. Once inventory reaches zero, Amazon immediately reallocates the Buy Box to sellers who can fulfill orders, regardless of authorization, reviews, or historical performance.

Q2: Can unauthorized or grey-market sellers win the Amazon Buy Box?

Yes, unauthorized or grey-market sellers can win the Amazon Buy Box if they have inventory available, competitive landed cost, and reliable fulfillment. Seller authorization and Brand Registry status do not prevent Buy Box eligibility when the brand is out of stock.

Q3: How long does it take to regain the Buy Box after a stockout?

Regaining the Buy Box after a stockout is rarely immediate. Once Buy Box ownership shifts, brands must compete again for eligibility against sellers who fulfilled orders during the stockout. Recovery can take days or weeks, even after inventory is fully replenished.

Q4: Does Amazon Brand Registry protect the Buy Box during stockouts?

No, Amazon Brand Registry does not protect Buy Box ownership during stockouts. The Buy Box prioritizes inventory availability and fulfillment reliability. When inventory is unavailable, Brand Registry status does not factor into Buy Box assignment.

Q5: How can brands prevent Buy Box loss from Amazon stockouts?

Brands can prevent Buy Box loss by maintaining continuous in-stock coverage, forecasting with Buy Box risk in mind, minimizing FBA check-in delays, reducing fragmented inventory ownership, and monitoring Buy Box changes before inventory gaps occur.

Share